tl;dr: Transferwise works with pre-stocking Pakistani Rupee (PKR) in partner bank. It’s legit and strengthens local currency when you use it to send remittances.

If you are a desi expat living abroad then it’s highly likely that you are already using Transferwise to send money across borders. I have been using Transferwise service for sending remittances to family back home (Pakistan) for past 3 years now. In layman terms, expats use it to send money from their foreign currency bank account (Euros in my case) to any bank account in one of the supported countries where recipient receives equivalent money in local currency (Pakistani Rupee in my case). I personally prefer it over other modes of payment because of several reasons, including cheapest transfer fees, best exchange rates, FCA regulated, mobile-first approach, reliability and amazing support team.

“The country largely depends on overseas Pakistanis to keep the wheel of the economy moving through their generous $20 billion” ~ Khaleej Times

All Overseas Pakistanis use this argument to support their patriotism but fact remains that remittances are extremely important for Pakistan’s economy. This is why question like “Am I doing Hundi/Hawala (which is illegal)?”, “Does my money really moves across borders when using Transferwise?” or in other terms “Am I really contributing into Pakistani economy by sending money through Transferwise?” matters a lot. I have thought about it many times but never felt important or concerned enough to research on it. Long story short, Pakistan’s new Prime Minister’s presidential address made me re-think about it because Imran Khan stressed on expats and remittances. Then I noticed two instances of facebook posts where people asked about it and somehow I got motivated to investigate it myself.

I already knew two things about their modus operandi. Firstly, TransferWise avoids costs by having their own local bank accounts in the majority of the countries they transfer to. That means that for these currencies no international transfers are actually needed, and the saving can be passed on to the customer. Secondly, their partner bank in Pakistan is Habib Bank Limited (HBL) and I learned this the hard way because once my transaction was delayed by them.

There were exchanges of 5 emails with support@transferwise.com to receive some clarity on this topic. My basic motivation was to verify if our remittances sent through their service actually crosses borders or not and also to get a bit deeper understanding of how they work.

Initially, support team told me this:

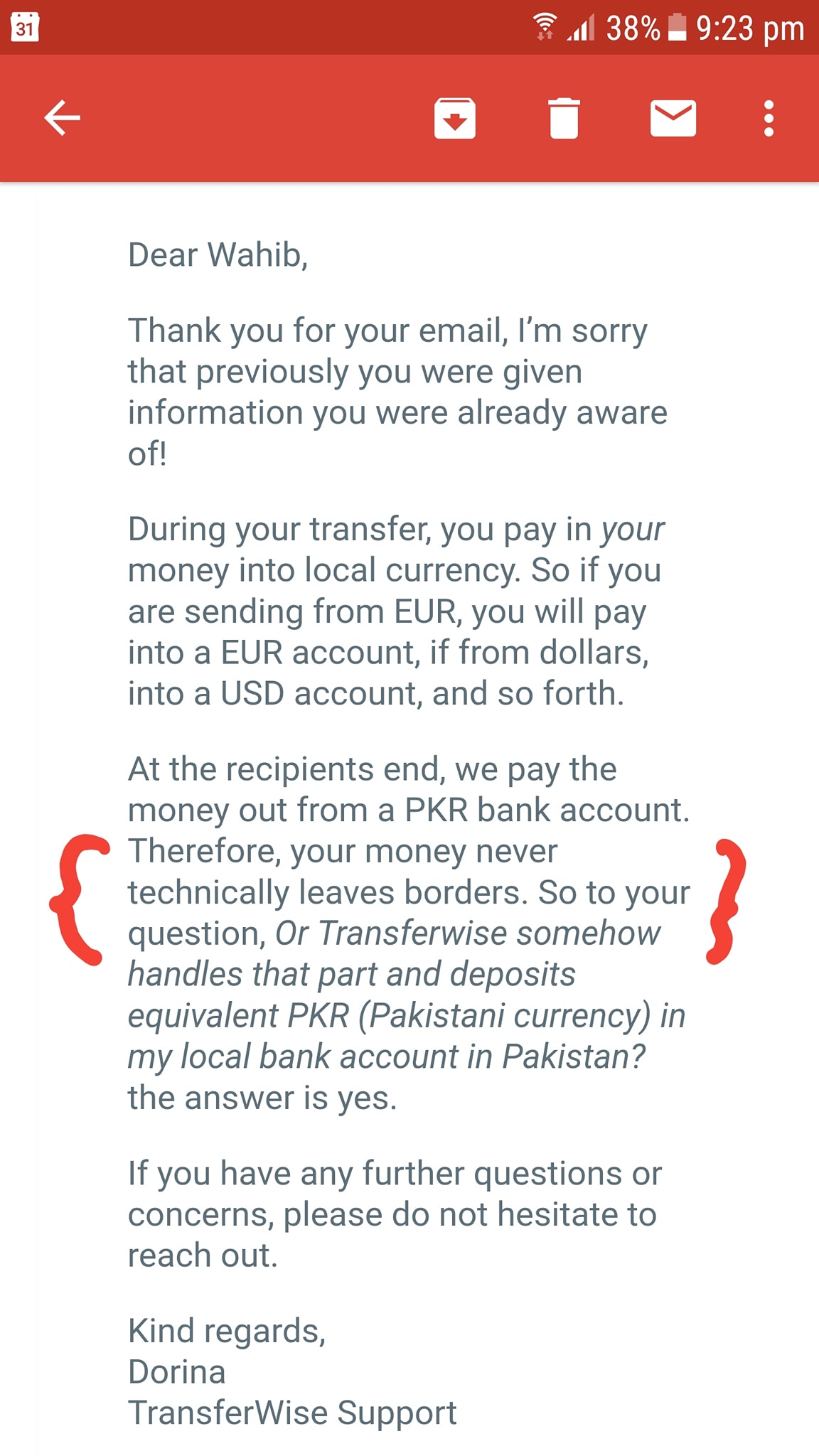

“At the recipients end, we pay the money out from a PKR bank account. Therefore, your money never technically leaves borders.”

Now, this made me worried but also made me think and eventually pushed me to share these 3 theories in the follow up email so that they can be verified.

1) Does Partner bank (HBL in this case) in Pakistan pays to my recipient bank account in PKR and Transferwise pay back to any international branch of HBL in Euros?

2) Transferwise already has a local bank account in PKR with pre-deposited money and they just use that account?

3) Transferwise business model goes something like this: if person A from Pakistan needs to send money to person B in UK and person C from UK is sending money to person D in Pakistan, they will essentially send C to B and A to D. And hence, the money never leaves border. To offset any imbalance in these payments they had previously deposited some extra cash in banks of each country but eventually everything balances out from within. (I’ll give credit to Shahqaan Qasim for this theory)

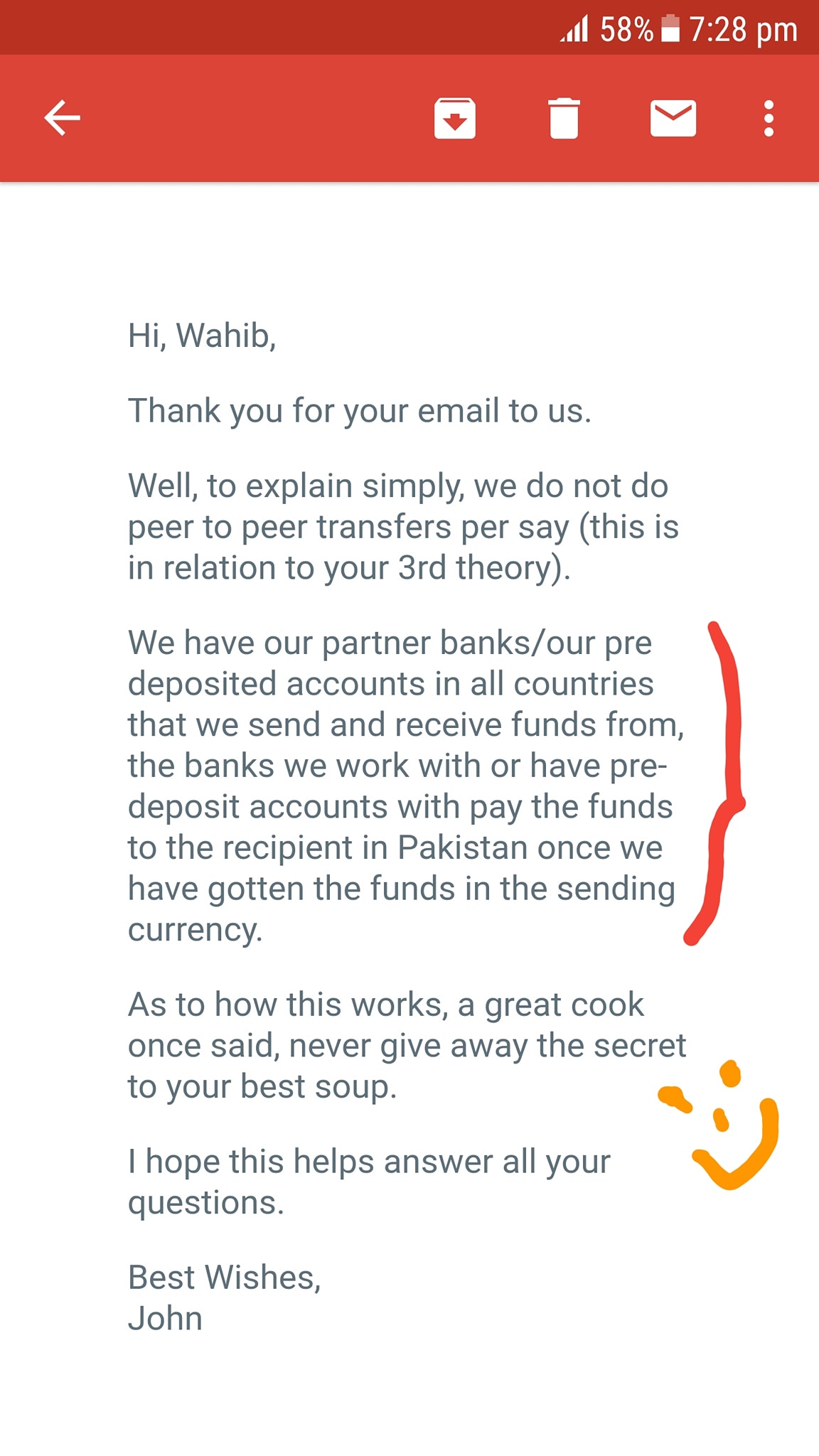

I received the response on the same day. They categorically denied the theory #1 and #2. Support rep shared this info which was the key piece of information for me.

“We have our partner banks/our pre deposited accounts in all countries that we send and receive funds from, the banks we work with or have pre-deposit accounts with pay the funds to the recipient in Pakistan once we have gotten the funds in the sending currency.”

It proved that theory #2 was correct! So what I can conclude is that Transferwise keep pre-deposited money in local partner’s bank account and use that channel to pay recipients. If their funds go low in that account then Transferwise will buy more local currency to fill it and most probably GBP curreny will be used for exchange.

Transferwise remittance transactions probably don’t directly result in bringing foreign currency across borders but indirectly it still contributes to it. When a banking entity in Pakistan becomes a part of whole chain of processes, it contributes to overall economy.

Verdict: It’s a win-win situation for us. Keep using Transferwise!

Update:

I recently found out that Transferwise has published a very comprehensive article on exactly this topic, What is Hawala? which further explains what I already concluded from my own research.

If someone knows more or have a different understanding then please feel free to reach out to me on twitter.

P.S If you are not using Transferwise but got convinced then maybe you can use this link to register and your first transfer of up to £500 will be free. I will also get referral bonus once you start using it.